This blog brings you the best Cryptocurrency & Blockchain, ICO & P2P and Exchange & Laws news. Also contains technology and research based post from all around the world every single day. Get informed! Think Future!

Saturday, 7 July 2018

Switzerland’s Stock Exchange Will Offer Cryptocurrency Services in Early 2019 This article was originally posted on The Merkel - with a dedicated cryptocurrency news section and also a variety of educational articles relating to Bitcoin, [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2MUdOJk

via IFTTT

Crypto Markets Hold Weekly Gains Amidst Little Action This article was originally posted on Cointelegraph - an independent publication covering cryptocurrency, the blockchain, decentralized applications, the internet of finance and the next gen [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2KHHAnK

via IFTTT

South Korea to Loosen Crypto Regulations This article was originally posted on Ethereum World News - an independent news provider covereing Ethereum, Bitcoin, Ripple, Litecoin dApps, start-off ICO’s and the whole Blockchain [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2MUdKt4

via IFTTT

Augur (REP) Wages War On Critical Vulnerability, Sets Aside $200,000 USD This article was originally posted on Ethereum World News - an independent news provider covereing Ethereum, Bitcoin, Ripple, Litecoin dApps, start-off ICO’s and the whole Blockchain [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2zirqMj

via IFTTT

Crypto Trading Platform Releases an Arbitrage Trading Soft for Beginners This article was originally posted on Cointelegraph - an independent publication covering cryptocurrency, the blockchain, decentralized applications, the internet of finance and the next gen [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2u2fXf5

via IFTTT

Should Bitcoin Switch to the Proposed PoWx Solution? This article was originally posted on The Merkel - with a dedicated cryptocurrency news section and also a variety of educational articles relating to Bitcoin, [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2m0tMWH

via IFTTT

US Presidential Candidate Would Pardon Snowden, Ulbricht on First Day This article was originally posted on Bitcoin News - delivering news related to the Bitcoin network from multiple locations around the world. For more follow [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2u8GVAE

via IFTTT

European Speed Trader Begins Trading Bitcoin and Ethereum Exchange Traded Notes (ETN) This article was originally posted on Ethereum World News - an independent news provider covereing Ethereum, Bitcoin, Ripple, Litecoin dApps, start-off ICO’s and the whole Blockchain [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2m0tJdt

via IFTTT

Charles Hoskinson’s Video Update Shows Promising Advances On The Cardano (ADA) Project This article was originally posted on Ethereum World News - an independent news provider covereing Ethereum, Bitcoin, Ripple, Litecoin dApps, start-off ICO’s and the whole Blockchain [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2lYRUZP

via IFTTT

Facebook Director of Engineering Moves to Same Position at Company’s Blockchain Team This article was originally posted on Cointelegraph - an independent publication covering cryptocurrency, the blockchain, decentralized applications, the internet of finance and the next gen [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2ukv9DJ

via IFTTT

Tezos Token Price Gets Battered Despite Testnet Launch This article was originally posted on The Merkel - with a dedicated cryptocurrency news section and also a variety of educational articles relating to Bitcoin, [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2m1V67i

via IFTTT

My exposé of the UASF backdoor censored by r/Bitcoin moderators who themselves tried to impose a UASF backdoor in the past. Looks like they may be seeing an opportunity to hijack the Schnorr signatures improvement for a second scam attempt after failing to do the same with SegWit.

There has been an update to the CoinEx dividend term period, it is being extended.

Account holders received the following info today.

To guarantee the sustainable development of CET and interests of CET holders, we decide to release a long-term dividend allocation plan by which CET holders will continue to receive dividends after “Trade-driven mining” ends. 80% of our total revenue will be allocated to CET holders and the remaining 20% is kept for CoinEx development and daily operations. The arrangements are as follows:

- Ratio: 80% of CoinEx’s total revenue from all features will be allocated to CET holders as dividends;

- Frequency: Every month;

- Allocation: 80% of CoinEx’s total revenue will be used to repurchase CET from the secondary market and allocated to qualified CET holders proportionately. If your CET holdings are on CoinEx, we’ll allocate the dividends directly to your accounts or otherwise, to your CET wallet addresses elsewhere. The locked part in CoinEx team’s 50% out of the total supply is qualified for dividend allocation as well.

We will then cancel the current policy to repurchase and burn CET with 20% of our monthly trans fee revenue.

[link] [comments]

source https://www.reddit.com/r/btc/comments/8wtrmd/there_has_been_an_update_to_the_coinex_dividend/

Stellar (XLM) Gets More Popularity As Co-founder Named In Blockchain Industry’s Top Ten Individuals This article was originally posted on Ethereum World News - an independent news provider covereing Ethereum, Bitcoin, Ripple, Litecoin dApps, start-off ICO’s and the whole Blockchain [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2KUmcYt

via IFTTT

4 Cryptocurrencies and an ICO Making Major Moves (WAN, ANON, VEN, REP, tZERO) This article was originally posted on Bitcoinist - one of the leading sources for information about Bitcoin, digital currency and blockchain technology. With one of [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2uc9j52

via IFTTT

Wendy McElroy: The Free Market Can Provide Law This article was originally posted on Bitcoin News - delivering news related to the Bitcoin network from multiple locations around the world. For more follow [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2m2sx9G

via IFTTT

Silver Miller’s Bitconnect Lawsuit Targets YouTube for Failure to Protect Users This article was originally posted on The Merkel - with a dedicated cryptocurrency news section and also a variety of educational articles relating to Bitcoin, [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2uc9ehK

via IFTTT

Kenya Has Two Weeks To Decide If Bitcoin Is A Legal Tender Kenyan MPs have given the Treasury secretary a two-week deadline by which they must decide the outcome of bitcoin and other cryptocurrencies, precisely regarding their status as legal tender in the nation of 48 million people. The deadline follows a warning issued in April by the Central Bank of Kenya (CBK). The National Planning Committee and Finance have asked agency officials to explain the acceptance of cryptocurrency trading in Kenya, as well as why the Treasury and the CBK were authorizing the free-for-all currencies to be traded and capitalized in with no licensing process or capital gains tax being required, echoing the acquainted situation being seen in nations around the world as government regulators begin to lastly take notice of the flow in crypto trading. In December 2015 the CBK did issue a notice to the public warning the public about the use of digital currencies, stating in the document that “virtual currencies such as Bitcoin are not legal tender in Kenya and therefore no protection exists in the event that the platform that exchanges or holds the virtual currency fails or goes out of business.” The notice goes on to list other risks associated with cryptocurrencies. Cryptocurrency Exchange Currently, Henry Rotich, head of macroeconomics at Treasury, disapproved the instability of cryptocurrencies by directing out the dramatic fall in bitcoin’s value seen over the last several months as an example, which possibly does not augur well for the classification of crypto as legal tender in Kenya. According to Rotich, cryptocurrency is still under review by the government in terms of whether it would be allowed to flourish in the country or be prohibited and regulated, pointing out the potential to facilitate money laundering as one of the primary concerns surrounding the technology. According to CCN, India lately went through the same procedure as Kenya is experiencing now, eventually ruling that bitcoin and other cryptocurrencies were not lawful tenders Must Read recommended by The post Kenya Has Two Weeks To Decide If Bitcoin Is A Legal Tender appeared first on OWLT Market.

Nano Community Feeds Multiple Venezuelan Families With Minor Donation Spree This article was originally posted on The Merkel - with a dedicated cryptocurrency news section and also a variety of educational articles relating to Bitcoin, [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2KFiHta

via IFTTT

Titanic Explorer Joins Tokenized Treasure Hunt Project This article was originally posted on Trustnodes - a trusted site covering numerous topics related to cryptocurrency and a great selection of news and editorial [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2MSuLUv

via IFTTT

Facebook Appoints Evan Cheng As Director Of Blockchain Engineering Facebook has appointed one of its senior engineers Evan Cheng as its first “director of engineering blockchain”. The new position was confirmed by Facebook and signals the company’s importance about the technology. Cheng has formerly been responsible for heading up Software design Languages & Runtimes at Facebook. Preceding to that, he held a 10-year stretch at Apple. His profile also claims that he has an expertise in crypto and blockchain like day job programming languages, runtimes, compilers, night job. According to Cheng’s LinkedIn profile, he helped as the director of engineering for programming languages and runtimes at Facebook for almost three years prior to his new focus on the blockchain, following a 10-year stint at Apple. The company launched a team exactly to discover this emerging technology. Facebook’s long-time head of its Messenger platform, David Marcus, was tasked with leading the team. The news also follows Facebook’s recent ease on a crypto-related ads ban. Back in January, the company disqualified all crypto ads, it has since silently set up an application form for many kinds of crypto ads to get posted in June. Director of Engineering Blockchain The new position is another confirming step that Facebook is easing up on its harsh stance regarding cryptocurrency and is eager to embrace the innovations of blockchain technology The company has very recently lifted its conditions surrounding the ban letting certain types of crypto ads to be posted, signifying a more tolerant stance is developing. In the month of May, Facebook had launched a team to discover blockchain technology. Its long-time head of its Messenger platform and top-executive at Facebook-California, David Marcus, was appointed as head of this team. Marcus is reported to be joined by a few executives from Instagram, a company Facebook also owns. According to Coindesk, Zuckerberg has been spoken about his interest in decentralized technologies. The idea behind his interest is obviously with a vision to apply it to Facebook. Must Read recommended by The post Facebook Appoints Evan Cheng As Director Of Blockchain Engineering appeared first on OWLT Market.

Not sure if it’s been posted on here before but is there anywhere online you could work in exchange for bitcoin? I mean small jobs like proofreading etc?

I created a Bitcoin.com wallet...Why can't I receive a faucet tip?

|

I downloaded the app on my desktop with my email address. I requested a faucet tip with my bitcoin.com desktop wallet address and got paid! I then downloaded a bitcoin dot com Android phone wallet with a different email address and did not get paid. Instead I receive this error: This service is not available. I'm not sure if bitcoin dot com thinks I'm trying to get more than 1 faucet tip or if something is actually wrong with their mobile service. Which is it? bitcoincash:qpj22u3vsjzrfkvtc9qjv8065xd4hsg77yldvmwdqm The above address is the mobile wallet Public Key. [link] [comments] |

source https://www.reddit.com/r/btc/comments/8wt40q/i_created_a_bitcoincom_walletwhy_cant_i_receive_a/

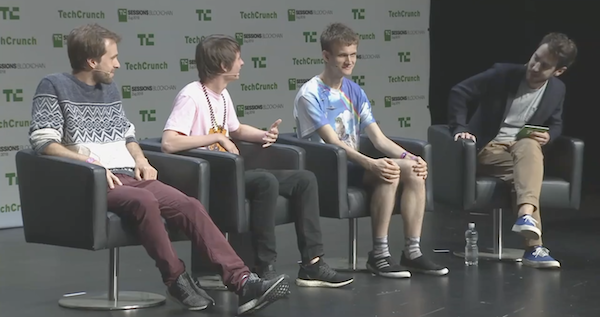

Ethereum’s Vitalik Buterin Blasts Centralized Crypto Exchanges: ‘I Hope They Burn in Hell’ This article was originally posted on Cointelegraph - an independent publication covering cryptocurrency, the blockchain, decentralized applications, the internet of finance and the next gen [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2NxtGT9

via IFTTT

Tron (TRX) Dishes $20,000 To 10 Outstanding Projects This article was originally posted on Ethereum World News - an independent news provider covereing Ethereum, Bitcoin, Ripple, Litecoin dApps, start-off ICO’s and the whole Blockchain [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2KWSBxV

via IFTTT

What Is StellarX? This article was originally posted on The Merkel - with a dedicated cryptocurrency news section and also a variety of educational articles relating to Bitcoin, [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2NuVuHE

via IFTTT

The Daily: Bitcoin Enters Indian Politics, Blockchain Obsession Grows This article was originally posted on Bitcoin News - delivering news related to the Bitcoin network from multiple locations around the world. For more follow [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2zjew0H

via IFTTT

Facebook Gets On The Blockchain Train With New Engineering Director This article was originally posted on Ethereum World News - an independent news provider covereing Ethereum, Bitcoin, Ripple, Litecoin dApps, start-off ICO’s and the whole Blockchain [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2u0DXir

via IFTTT

First Blockchain Advert Shown on Prime Time TV During the World Cup This article was originally posted on Trustnodes - a trusted site covering numerous topics related to cryptocurrency and a great selection of news and editorial [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2ujY7DJ

via IFTTT

Bitcoin Mining Giant Bitmain Worth $12 Billion After Latest Funding Round This article was originally posted on Bitcoinist - one of the leading sources for information about Bitcoin, digital currency and blockchain technology. With one of [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2u1IBNr

via IFTTT

Chinese Mining Firm Bitmain Valued At $12Bn One of the largest Bitcoin (BTC) mining companies internationally, Bitmain, is now valued at $12 billion succeeding a Series B round of funding. Bitmain upraised between $300 million to $400 million from Sequoia Capital subsidiary Sequoia China, U.S. hedge fund Coatue, and Singapore-based governmental investment fund EDBI. Beijing-based Bitmain had received $50 million In September 2017 in a Series A funding round from Sequoia Capital and IDG Capital. According to Jihan Wu the company’s CEO the company has plans to conduct an initial public offering (IPO) in Hong Kong also, an IPO in the region would be an appropriate means for letting early investors to cash in their funds. On the other hand one of the Bitmain’s main competitors, China-based Canaan Creative, had announced that it would start an IPO on the Hong Kong Stock Exchange in July. Bitmain crypto exchange Bitmain Technologies is a privately held company that develops Bitcoin mining hardware and ASIC chips. The firm reportedly held 70-80 percent of the market for Bitcoin mining hardware in February 2018. Bitmain also operates one of the largest Bitcoin mining pools, Antpool. In 2017, the company was reported to be present in the expansion of Ant Creek mining centers in the U.S. Bitmain had led a $110 million funding round for US cryptocurrency firm Circle, trading desk, a retail-focused brokerage app, a cryptocurrency exchange, and plans to shape a USD-pegged “stablecoin.” Particularly, Sequoia Capital China is presently involved in a legal battle with cryptocurrency exchange Binance based out of Hong Kong who the VC company has sued for allegedly disrespectful an individuality agreement stopping from fundraising discussions held last year. As Coin Telegraph reported, Bitmain has even started designing ASIC marks for wrong intelligence-related applications, and CEO Jihan Wu has stated that this field could account for 50 percent of the company’s income within five years. Must Read recommended by The post Chinese Mining Firm Bitmain Valued At $12Bn appeared first on OWLT Market.

"They will tell you, they are worried, that criminals will use Bitcoin. The truth is, they are much more terrified, that all the rest of us will" (- A. Antonopoulos) ... which is why Blockstream limited the capacity and derailed the project into harmless "store of value".

Blocksize discussion pre-2016: "Hey did you guys notice theres a limit on the block size?" "oh yeah, it's a spam protection" "what are we gonna do when it's not big enough?" "we'll just make it bigger" "oh okay, that makes sense".

As someone that's been involved since 2013, I can still remember what /r/bitcoin used to be like. There was an air of intellectual curiosity, comaraderie, and bravery. Most people still thought we were "crazy". When you wanted to talk to someone about bitcoin, you had to start from zero, no one had any fucking clue what it was, and if you told them it was like pulling teeth and they'd tell you to your face you were nuts and definitely buying into a scam and/or "ponzi scheme".

In this earlier community, the blocksize would be brought up occasionally. Everyone knew it would require an update, and that was just accepted. It was assumed that the blocksize would have to increase, because bitcoin was always meant to be cash for everyone, and having a system that actually dared to do that and was actually proving it could was already so audacious, that the thought of some 2nd layer or alternative system was not even considered. Bitcoin was already a crazy idea, why would we dare to push the limits even further? If Satoshi's original implementation was more-or-less good enough to get us from 2009 to the present, it would be good enough to go forward, and that's what we were betting on. We weren't buying into something that would maintain 1MB blocks and be a 'store of value'!

It really makes me sick thats something so trivial, and so uncontentious, was able to completely splinter the community and suck away so many newcomers. And it makes me absolutely livid when they call it "bcash", when most of them are latecomers who don't even understand the vision. I think so many people are just interested in a get-rich-quick scheme these days, and don't even realize how insane this whole project was from the beginning.

In case anyone has doubts about the intentions of Nakamoto and the other early developers, remember that the genesis block contains a hash of the string "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks". 2008 was nothing short of a massive theft from the middle class by the upper class. Nakamoto doesn't remain anonymous because it's cute, he's anonymous because blockchain has the potential to massively disrupt the current power structure of this world. And most of us believe that that structure is topped by those who hide in the shadows and murder and lie and steal to maintain the status quo. If you aren't on board with that, then get the fuck out, because we aren't there yet, and we are just now this past year seeing what exactly that means for the lifecycle of this great experiment, which will have more losers than winners.

[link] [comments]

source https://www.reddit.com/r/btc/comments/8ws8om/blocksize_discussion_pre2016_hey_did_you_guys/

"Don't be discouraged if what you produce initially is something other people dismiss ... In fact, that's a good sign. That's probably why everyone else has been overlooking the idea." - Paul Graham

The "little things" make the biggest difference when everybody thinks that everyone is already doing it. (But not everyone actually is).

Proof of Work

[link] [comments]

source https://www.reddit.com/r/btc/comments/8ws92v/dont_be_discouraged_if_what_you_produce_initially/

Stellar (XLM) Partnership with IBM Backed By Australian Gov This article was originally posted on Ethereum World News - an independent news provider covereing Ethereum, Bitcoin, Ripple, Litecoin dApps, start-off ICO’s and the whole Blockchain [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2NyhqSv

via IFTTT

From $2.9 Billion in a Month to Hundreds Dead: Trends of the Rollercoaster ICO Market in 18 Months This article was originally posted on Cointelegraph - an independent publication covering cryptocurrency, the blockchain, decentralized applications, the internet of finance and the next gen [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2zebgng

via IFTTT

NYSE’s Top Tech Executive Joins Gemini Trust As CTO According to a press release, Former Chief Information Officer of the New York Stock Exchange (NYSE), Robert Cornish joins crypto exchange Gemini Trust Company, LLC (Gemini), as the new Chief Technology Officer (CTO). Cornish will be the first-ever CTO of Gemini, which was founded by the Winklevoss brothers. Earlier Cornish had helped several other senior positions at the International Securities Exchange. Institutional Investor named him as a Trading Technology Top 40 Financial Services executive. In his position as CTO at Gemini, Cornish will look into leading technology initiatives as well as monitor the deployment of Nasdaq’s SMARTS Market Surveillance technology. The deployment of this technology will provide Gemini with the control of its auctions and all its order books. Gemini CEO Tyler Winklevoss in his statement mentioned that Cornish will be ensuring that Gemini continues delivering the best platform experience to its customers. He further stated that Cornish will also be responsible for setting the standards of excellence for the cryptocurrency industry. A recent wave saw Wall Street executives jumping towards digital currency start-ups this year. In line with this trend, Cornish too jumped on the wave of Wall Street executives who were migrating to crypto and blockchain projects. This year saw Priyanka Lilaramani, former Goldman Sachs Executive Director join a Maltese crypto start-up, HOLD, as its new CEO. Likewise, Dr. Rolf Werner, head of Central Europe, Fujitsu joined IOTA Foundation. Last year, former PayPal and Facebook executive, David Marcus was added to the list of Coinbase’s board of directors. As reported by Coin Telegraph, Gemini announced in April this year that it would start offering crypto block trading outside of their regular order books. Investors who are keen on trading on the Gemini Block Trading marketplace are now able to sell and purchase large amounts of digital currencies. Must Read recommended by The post NYSE’s Top Tech Executive Joins Gemini Trust As CTO appeared first on OWLT Market.

Ethereum Price: Small Uptick can Push Value to $475 This article was originally posted on The Merkel - with a dedicated cryptocurrency news section and also a variety of educational articles relating to Bitcoin, [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2J2mHyh

via IFTTT

Casper Perhaps in 2019, Sharding Maybe in 2020 Says Ethereum Researcher This article was originally posted on Trustnodes - a trusted site covering numerous topics related to cryptocurrency and a great selection of news and editorial [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2NxOF8d

via IFTTT

ETF Trader Moves Into Crypto Despite Regulator’s Warning One of the major speed trading company in Europe has hopped into the crypto markets, disregarding its regulator’s warnings to customers and organizations not to involve in crypto markets. Financial Markets (AFM) a Dutch Authority has taken a warning stand on cryptocurrencies, stating that there could discourage activities in cryptos both by consumers and professional license holders. XBT Provider, a Swedish crypto ETN issuer mentioned that the flow Traders has radically increased trading volumes. Particularly, market observers believe openly traded notes/funds would make crypto trading more interesting for organized investors as it is a secure and simple way to gain contacts to the exciting new asset class. AFM Demoralizes Activities in Crypto exchange As per Nienke Torensma, a spokesperson from AFM stated that with the virtue of its newness and the secrecy fortunately for Flow Traders NV, the AFM can’t stop firms from trading regulated instruments on regulated exchanges. Flow Traders NV evidently needs to stay on side with the controllers, with Dennis Dijkstra saying that “The biggest thing is keeping the regulators on board.” In spite of continuing disapproval from numerous institutions such as the BIS and the Bank of England, big institutional trading firms have been entering the market even though retail interest has been ebbing since December. Laurent Kssis, managing director at XBT Provider stated that with the increasing interest from institutional clients eager to invest in digital assets, and several proprietary trading businesses are now focusing on this new asset class. XBT Provider is part of London-based CoinShares company. As with most authorities, the AFM wishes a united global regulatory method to cryptocurrencies. In this respect, Malta has been making development while the UK industry body CryptoUK has also been pushing for regulations. With so many jurisdictions, however, drafting their own regulations it may be some time before a unified approach is established a spokesperson said to Crypto Globe. Must Read recommended by The post ETF Trader Moves Into Crypto Despite Regulator’s Warning appeared first on OWLT Market.

Total Market Capitalization Of All Cryptocurrency Exchanges Remains Stable Crypto markets remain to see mixed signals, but hold recent gains Bitcoin (BTC) is puzzling $6,600, trading at $ 6,650 at press time, up just about 1 percent over the 24-hour period. The foremost cryptocurrency holding increases made since June 30, solidly trading above the $6,300-6,400 confrontation level. On the other hand, ETH is also holding gains made during the market uptick June 30, which saw the coin rise up from near $400. The most important altcoin Ethereum (ETH) is up over two percent over the past 24 hours, trading at $470 at press time. In terms of the top gainers, Tezos (XTZ) has seen the most growth over the past 24 hours. The coin is up 9 percent, trading at $1.81 per coin. From the newly reported on the story of the controversial project, which raised up a then record-breaking $232 mln in its Original Coin Offering (ICO) and has since been the subject of numerous controversies. Total market capitalization At present, a complete market capitalization of all cryptocurrencies is at somewhere $269 billion from its intraday low of $261 billion, but down from yesterday’s $273 billion. Ethereum Classic (ETC) is also up notably, seeing 8 percent growth on the day to press time and trading at $18.27. It also stressed the requirement for a balanced financial regulation across the whole country. Over the past 24 hours, NEO and IOTA (MIOTA) have seen the major losses. NEO, that saw substantial growth of around 8%, is going into reverse regarding seven percent on the day and mercantilism at $37.54. The coin has seen a humongous 33.5% growth over the past week. According to data from Coin Telegraph, crypto markets has current gains, with most coins changeable mildly, crypto-related risks are likely to increase with more number of participation from government financial institutions and one of the top ten coins on CoinMarketCap are seeing only slight fluctuations over the past 24 hours to press time. Must Read recommended by The post Total Market Capitalization Of All Cryptocurrency Exchanges Remains Stable appeared first on OWLT Market.

PR: Titanic Explorer Joins PO8 – a Bahamian Company Using Blockchain to Recover Underwater Artifacts This article was originally posted on Bitcoin News - delivering news related to the Bitcoin network from multiple locations around the world. For more follow [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2KBX5O4

via IFTTT

Shouldn't the subs be switched, lol

Slightly joking but wouldn't it make more sense for the whole BCH == Bitcoin make more sense to follow, naturally, on /r/Bitcoin rather than /r/btc because BTC == Segwit (no?) And BCH == Bitcoin

[link] [comments]

source https://www.reddit.com/r/btc/comments/8wr933/shouldnt_the_subs_be_switched_lol/

[RELEASE] Spend and Replace is now enabled on the CashPay wallet!

Video How To Enable Spend and Replace https://www.youtube.com/watch?v=zwx1AOGO7I0

It’s finally here! Spend and Replace is enabled on the CashPay wallet making it possible replace the Bitcoin Cash you spend!

1) Spend and Replace works as follows: You connect your Coinbase account with CashPay and enable Spend and Replace in the wallet you want to use. Every time you spent an X amount of Bitcoin Cash, the same amount of Bitcoin Cash (minus Coinbase fees) will be bought on your Coinbase account using the fiat available in your account.

Please watch the following How To video to enable Spend and Replace https://youtu.be/zwx1AOGO7I0 or click on the following link for a step by step walkthrough: https://www.cashpay.solutions/how-to-enable-spend-and-replace/

2) Mind that although CashPay does not charge any fee for Spend and Replace, Coinbase buy fees apply and differ from country to country.

3) If you do not have fiat available in your account but you do have Spend and Replace enabled, mind that the next best thing will be used. This means if you have a bankaccount or creditcard connected to your Coinbase account, this will be used for Spend and Replace. Coinbase fees apply.

Download the CashPay wallet:

iOS: https://itunes.apple.com/en/app/cashpay/id1370940083?l=en&mt=8

Android: https://play.google.com/store/apps/details?id=com.cryptonize.cashpay

[link] [comments]

source https://www.reddit.com/r/btc/comments/8wrwh2/release_spend_and_replace_is_now_enabled_on_the/

क्रिप्टो की राह आसान करेगी मलेशियन सरकार व्यापार में क्रिप्टोकरेंसी की उपयोगिता इसके इस्तेमाल को सरल बनाने के लिए मलेशियन सरकार सार्थक प्रयास कर रही है । जिसका आधार मलाया यूनिवर्सिटी की वो रिपोर्ट है जिसमें आर्थिक विकास में तेज़ी लाने के लिए क्रिप्टोकरेंसी को व्यापक रूप से प्रयोग करने की सिफारिश की गयी है। साथ ही इस बात पर भी ज़ोर दिया गया है की नियामकों में थोड़ी नरमी बरती जाने चाहिए ताकि ब्लॉकचेन और क्रिप्टोकरेंसी के उपयोग के लिए और अधिक लोगों को प्रेरित किया जा सके। नहीं है कोई पाबंदी गौरतलब है कि वर्तमान में मलेशिया में क्रिप्टो से सम्बंधित लेनदेन के व्यापार पर कोई कड़ा कानून नहीं है और न ही अभी तक किसी भी क्रिप्टो ट्रेडिंग पर कोई पाबंदी लगाई है। बावजूद इसके ब्लॉकचेन से जुड़े निवेशक और ग्राहक दोनों संतुष्टि के साथ व्यापार करने में संकोच करते है। इस स्तिथि को दूर करने और ग्राहकों को सुरक्षा देने कि मंशा के साथ मलाया यूनिवर्सिटी ने सरकार को ऐसी रिपोर्ट सौंपी है। जिसमें कहा गया है कि बैंक और वित्तीय सेवाओं से जुड़े नियामकों ख़ास तौर से टैक्स प्रणाली और शर्तों को नए सिरे से सरलता के साथ लागू किया जाए ताकि क्रिप्टो के व्यापार को बढ़ा कर अर्थव्यस्था को मज़बूत बनाने का काम हो सके। ब्लॉकचेन और क्रिप्टो को बढ़ावा क्रिप्टो वेस्ट के अनुसार मलाया यूनिवर्सिटी ने कवांट रेग टेक कैपिटल के साथ संयुक्त रूप से इस रिपोर्ट को तैयार किया कवांट रेग टेक कैपिटल ब्लॉकचेन स्टार्टअप सस्था है जो की ब्लॉकचेन के उपयोग के साथ साथ क्रिप्टोकरेंसी को बढ़ावा देने के लिए कार्य कर रही है। ब्लॉकचेन को लेकर हाल ही में कुआलालम्पुर में एक ट्रेनिंग सेंटर भी स्थापित किया गया है। ब्लॉकचेन विशेषज्ञों का मानना है की 240 पेज कि इस रिपोर्ट को आधार बनाते हुए क्रिप्टो और ब्लॉकचेन के प्रति गंभीरता से सरल नियामक का गठन करेगी। जिससे ग्राहक और निवेशक दोनों को व्यापार में सुविधाजनक रास्ता मिल सकेगा। Must Read recommended by The post क्रिप्टो की राह आसान करेगी मलेशियन सरकार appeared first on OWLT Market.

DHFL Pramerica Mutual Fund Introduces Insta Cash Fund Redemption Option DHFL Pramerica Mutual Fund has launched instant redemption facility for its investors under the growth option of DHFL Pramerica Insta Cash Fund option in Dept Funds category, the fund house announced in newspaper. According to the source, the scheme facilitates their investors for instantaneous redemption through their website. It allows for a minimum redemption of 100 Rupees and in multiples of one Rupee thereafter. All other features of the plan stay unaltered. The date of launching and other details of the instant redemption facility for the liquid fund is not yet clear. Earlier on March 26, DHFL Pramerica Mutual Fund launched daily systematic transfer plan facility under some of its schemes, confirmed a report from the above source. Under the daily systematic transfer plan facility, investors are allowed to daily transfer a fixed amount of their money to any target plan from a source plan. The eligible target plan will be all the open-ended equity schemes, and the source plan falls under the DHFL Pramerica Insta Cash Plus Fund. The minimum instalment amount allowed for all open-ended equity plans except for the fund house’s Long Term Equity Fund will be 100 Rupees and in multiples of 100 Rupees thereafter, with a minimum of 60 instalments. The minimum instalment allowed for the DHFL Pramerica Long Term Equity Fund will be Rs. 500 and in multiples of Rs. 500 thereafter, with a minimum of 30 instalments. In an interview with MoneyControl in January 2017, Mr. Akash Singhania, Deputy CIO and Head Equities, DHFL Pramerica Mutual Fund, said corporate earnings are anticipated to reach 14-15 percent in the succeeding 3-5 years, and that the earnings would remain at 10-12 percent for the next 2 years. Singhania also added that the 14-15 percent earnings growth is possible with entry of GST and with the “clean-up of NPAs in the banking sector,” according to the source report published earlier. Must Read recommended by The post DHFL Pramerica Mutual Fund Introduces Insta Cash Fund Redemption Option appeared first on OWLT Market.

Two New Crypto Exchanges Approved By Philippines Central Bank According to a recent Business World report, the central bank of Philippines, Bangko Sentral ng Pilipinas (BSP), has approved two new crypto exchanges, this Friday. Speaking to reporters, Deputy Governor, Chuchi G. Fonacier said that the regulatory authority has approved the applications that were filed by Etranss and Virtual Currency Philippines Inc. to convert pesos into virtual currencies such as Ethereum and Bitcoin. This takes the number of approved crypto exchanges in the country to five. Betur Inc., also known as Coins.ph was the first exchange that was approved in September last year. A month later another exchange that was approved was Rebittance Inc. Earlier in May this year, Bloom Solutions was approved. It is the third crypto exchange operator in the Philippines. As a move against black money, the Philippines Anti-Money Laundering Council said that it will start to closely monitor all crypto transactions taking place in the country. Earlier the central bank proposed that crypto exchanges need to have separate licenses in order to operate as electronic issuers of money. The council is further analyzing if they need the exchanges to sign up as e-money issuers given the fact that they maintain e-wallets for their clients. Fonacier in her statement this Friday mentioned that according to internal consultations, it may not be advisable to simplify the registration process in a bid for these new players. She said that they are refining the rules further. According to Bitcoin News, crypto exchanges that are signing up as issuers of e-money need to have a minimum capital of 100 million pesos. Also, the existing BSP rules impose P100,000 as the aggregate load limit per month for e-money instruments. The government-owned Cagayan Economic Zone Authority (CEZA) announced last week that it is drafting regulations for cryptocurrencies. It is also planning to license around 25 crypto companies. Must Read recommended by The post Two New Crypto Exchanges Approved By Philippines Central Bank appeared first on OWLT Market.

Bitcoin’s Past, Present, and Future: This Week’s Review This article was originally posted on Bitcoinist - one of the leading sources for information about Bitcoin, digital currency and blockchain technology. With one of [...]

from Crypto News Monitor | Crypto news from the worlds most reputable sources https://ift.tt/2u1tZO5

via IFTTT

SIX, Swiss Stock Exchange Operator, Plans To Launch SWISS Digital Exchange Switzerland’s key stock exchange owner and operator, SIX has announced to launch the SIX Digital Exchange. This exchange will be a crypto assets exchange that will be entirely regulated by the country’s central bank and financial regulator. In a statement issued on Friday, SIX revealed its new initiative stating that this will be the first market infrastructure in the world to offer custody service for digital assets, settlement, and fully integrated end to end trading. The blockchain powered platform, SIX Digital Exchange (SDX) will enable the trading and issuance of digital assets. It will also facilitate the existing securities of its clients’ to be tokenized. The SIX head of securities and exchange, Thomas Zeeb mentioned in his statement that the digital exchange will facilitate its clients to settle, trade, and hold custody of digital assets in the same manner as it is presently done in the traditional world on one single platform. This new platform will be subject to the same standard of oversight and regulation from FINMA, Swiss National Bank, and the country’s financial regulator. SIX CEO, Jos Disjsselhof, who is leading this launch of the new exchange, said that this is just the beginning of a new era for capital market infrastructures. According to the CCN report, Jos further mentioned that SIX will also enable its clients to offer their own tokens via initial coin offerings (ICOs) in order to raise funds. Zeeb added that they are building a team of advisors and developers that will assist its clients to create new products and ICOs. The exchange operator pointed out that SDX won’t be used to enable direct trading of cryptocurrencies such as Ethereum and Bitcoin. It will instead introduce traditional financial market participants to tokenize their non-bankable and bankable assets into digital assets. Must Read recommended by The post SIX, Swiss Stock Exchange Operator, Plans To Launch SWISS Digital Exchange appeared first on OWLT Market.

Crypto Exchanges Gain Official Recognition In South Korea As Financial Institutions In a historic move, the government of South Korea has decided to officially recognize cryptocurrency exchanges as financial institutions. A local South Korean publication has reported that the South Korean financial authorities have decided to categorize crypto exchanges as an industry by the name of Cryptocurrency Exchange and Brokerage. Supported by local authorities, trading platforms will now be enabled to perform at a large capacity. The South Korean government has been mulling upon the idea of considering regulating the cryptocurrency sector by implementing practical regulations and policies. This initiative was decided upon especially to prevent security breaches and large-scale hackings from taking place. Post the Coinrail and Bithumb hackings in early 2018, the South Korean government has been quite vigilant. However, the local financial authorities are concerned that if the cryptocurrency market is regulated, the local public would assume that the government has legitimized the cryptocurrency sector. As a result of this thought, the regulation of cryptocurrency exchanges was postponed by the South Korean government. In a turn of events this week, the local publications reported that the South Korean government has reached a common consensus to recognize cryptocurrency exchanges as regulated financial business. This decision will help in creating a new industry that will be dedicated towards cryptocurrency trading platforms. On the flip side, this newly created regulatory framework is likely to have a negative bearing on both investors and trading platforms in the short-term. This is primarily due to the introduction of stricter customer verification policies, Know Your Customer (KYC), and Anti-Money Laundering (AML) policies. It may also need crypto exchanges such as Coinone, Korbit, and Bithumb to overhaul their internal management systems and significantly enhance their security measures in order to be in compliance with the newly introduced policies. As reported in CCN, local analysts are however hopeful that in the long run, this decision to legitimize the cryptocurrency sector will invite retail traders and large-scale institutional investors to enter the crypto market. The government has also planned to alter the existing regulations to facilitate decentralized applications. Must Read recommended by The post Crypto Exchanges Gain Official Recognition In South Korea As Financial Institutions appeared first on OWLT Market.

[Announcement] We're launching Bitreon.cash, a Bitcoin Cash powered content membership platform

Abstract

With Patreon disabling cryptocurrency payments, we see an opportunity to create a Bitcoin Cash membership platform that brings complete freedom and control to content creators and their subscribers. The security of payments (no fear of chargebacks),, the anonymity and the privacy offered by Bitcoin Cash and the Bitreon platform will make it possible for creators to reach theirmaximum creative potential and the subscribers to enjoy the best their favorite creators can offer.

We're aiming to make Bitreon.cash the most popular content membership platform on the Internet, making Bitcoin Cash adoption skyrocket and enable people to earn all over the world.

What makes Bitreon.cash awesome?

- Electron Cash plugin for recurrent payments to your favorite content creators without hassle

- Privacy: You can register anonymously and get paid without adding your personal info

- Freedom: If it's legal, you can share it. We impose zero censorship and terms for the content you share and will always defend your right to free speech. Go wild!

- Exposure: We will put highly paid and popular content on the Featured list and help you reach your maximum potential of success.

- Fairness: We'll keep our fees low indefinitely in order to encourage creators to reach their maximum potential instead of worrying about the bills.

Who are we?

Jimmy Birer - Backend and Linux System Developer, creator of Cashflow.fm and the React Online Wallet on github

Maciej Bowkorski - Front-End Engineer

Tim Potter - Investments Manager at Bitcoin.com

Whats our plan?

We're working hard to deliver Bitreon.cash minimum functional viable product for testing at 1 August and to also deliver the complete app on 1 September. We'll embark on an unprecedented international advertising and marketing campaign (for a project of this size) to dethrone restrictive and bank-dependent membership platforms and help Bitcoin Cash gain the adoption it deserves.

What do you need the fundraiser for?

We're bootstrapping the code, design, and infrastructure with our own funds but we need more for worldwide scale marketing and the new iteration of Bitreon with advanced social features and rewards system. We want Bitreon to reach so many countries and people that it'll become a threat to crypto-adverse membership platforms and help Bitcoin Cash reach it's true spot as the #1 coin. We accept only Bitcoin Cash for funds.

How much have you raised?

A kind anonymous donor provided us with 5.21 BCH as seed fund for programming and infrastructure. We thank them kindly for this.

Donations:

We accept u/tippr or better yet, click "Join Fundraiser" on our website and follow the steps. We are giving away equity based on the amount of donations (i.e 2 BCH is 2% percent until we meet 100 BCH hard cap). Thanks for supporting us in our dream to free content creators and help BCH reach it's deserved place as the #1 coin!

[link] [comments]

source https://www.reddit.com/r/btc/comments/8wqxmx/announcement_were_launching_bitreoncash_a_bitcoin/

Ryan X. Charles:"If there were 200,000 tx/s on Bitcoin Cash you could reliable do coinjoin and merge avoidance with every transaction. Privacy improves with scale."

Want to spread adoption? Tip one person you upvote outside r/btc a day

This is a quick, unoriginal idea i had that i thought would be worth writing a post on. As the title suggests,

Tip one person you upvote outside r/btc a day

If just 1000 of us commit to tipping 1 person in a community you contribute to once a week, that's 1000 people who are (at the very least) made aware of BCH's existence and utility. Even if only 1% of those people read further into BCH, the butterfly effect of their possible contributions serves as a catalyst for further adoption.

For example, the u/tippr bot is fast to respond to queries/tips and works on most subreddits.

I've been tipping with it on r/pcmasterrace, r/blurrypicturesofdogs & r/PewdiepieSubmissions (Linked are 3 of my tips). If you find the bot is banned i suggest that you link the user to a previous tip you've made showing the bot so they can see it in action along with the great informative links it has in its footer.

Recently I've been making a habit of tipping more frequently on reddit, twitter and in videogames like Dota 2 and Diablo 3 (Cointext.io is a great service to show off when casually chatting with others ingame!). Most people are very curious about BCH - especially when you're offering them some casually; The tip i made on r/PewdiepieSubmissions for example was the 2nd top comment with 570 odd upvotes while the tips i made In-game have lead to some great conversations and friendships.

I'd argue that tipping is by far the most effective way to promote adoption with minimal effort and cost on your behalf.

5 minutes and a few bits is all it takes to be a part of BCHs PR team. You might even get a powerlevel or two out of it.

Edit: NP'd the links

[link] [comments]

source https://www.reddit.com/r/btc/comments/8wq8p2/want_to_spread_adoption_tip_one_person_you_upvote/

Doesn't a 'fork' of Bitcoin imply that whichever of the forked blockchains is truly 'Bitcoin' is debatable?

At first I was brainwashed by the Bitcoin reddit into thinking that Bitcoin, Segwit and LN are the way.

After doing research and learning of the censorship (and its intent) I am convinced that BCH represents the true intent of Bitcoin.

One criticism of those like Roger Ver is that he calls BCH the real Bitcoin - I don't think he is wrong. And who is to say he is?

The community should decide. A fork means that two cryptos emerged from one. Who is any one person to say that one is truly Bitcoin vs. the other?

[link] [comments]

source https://www.reddit.com/r/btc/comments/8wqqwc/doesnt_a_fork_of_bitcoin_imply_that_whichever_of/

I used the Bitcoin.com store today to buy some T-Shirts. Overall great experience, but it did not feel like using cash.

It felt like your usual online transaction with the difference that you pay with Bitcoin Cash.

I think that one of the coolest things about using Bitcoin Cash is the fact that it can operate as Cash even over the internet. Technically absolutely no personal information needs to be exchanged - this needs to be leveraged better.

I suggest some sort of "Cash-Checkout" option, where you only provide absolutely necessary details and nothing more, in my case that would have been shipping details. No account needed, no name, no email, no billing address. Is this possible or are there some legal ramifications to it?

Also, when adding something to the Cart it redirects you to the cart instead of allowing you to continue shopping which doesn't seem like the best UX.

Just my two satoshis!

[link] [comments]

source https://www.reddit.com/r/btc/comments/8wotkh/i_used_the_bitcoincom_store_today_to_buy_some/

Rick Falkvinge: Projects fail for social or market reasons, and never for not having the best developers. Lessons from the early Internet (which outcompeted the incumbents of its day).

So I want to sell my coffee via open bazaar so that I can earn some bitcoin cash.. why? I want to purchase lovely Mount Elgon coffee direct from a coffee & honey co-operative in Uganda.. can we use #cryptocurrency to change the world? ♡

-

Crypto is pretty much the only reason I used Reddit anymore, and I'd like to stop using this website. submitted by /u/TheTruthHas...

-

submitted by /u/FearlessEggplant3036 [link] [comments] source https://www.reddit.com/r/btc/comments/12gt49l/supposedly_insiders_in_t...

-

submitted by /u/KillerHurdz [link] [comments] source https://www.reddit.com/r/btc/comments/a6bm9y/discussing_bitcoin_power_dyn...

![Bitcoin Cash[BCH] eyes $760 handle: BCH price prediction and technical analysis Bitcoin Cash[BCH] eyes $760 handle: BCH price prediction and technical analysis](https://b.thumbs.redditmedia.com/O_G5-fDwheHoEo2zftIe6UgW5EL9GTiaAME6qXB4YoY.jpg)

![Roger Ver Vs Blockstream Supporter [FULL DEBATE] Roger Ver Vs Blockstream Supporter [FULL DEBATE]](https://b.thumbs.redditmedia.com/gvQDM930IPfE_EQXGlE4LDMSmco1Uh8HJuQ4mYl09ow.jpg)